South Africa’s Informal Retail Boom

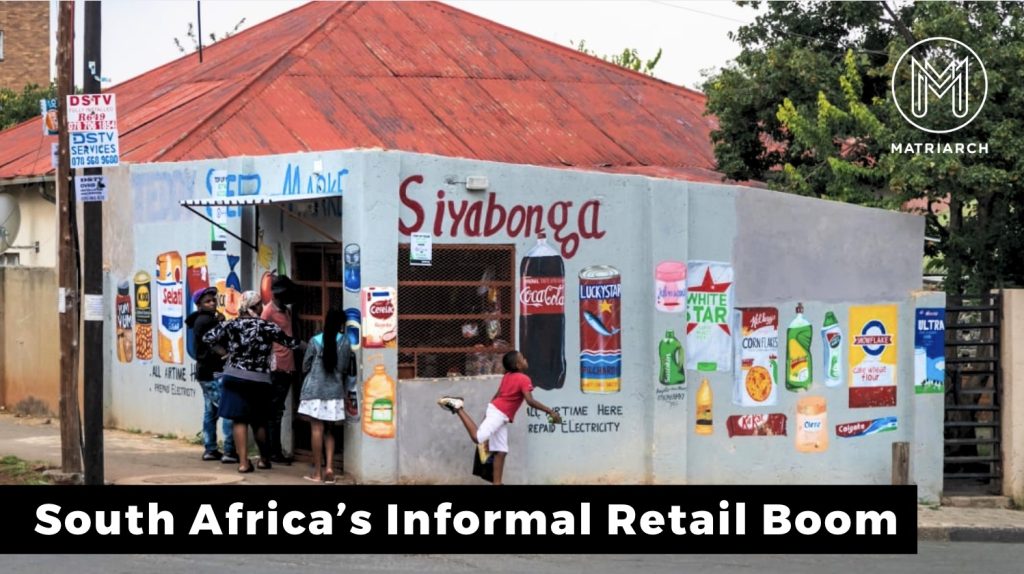

South Africa’s retail landscape is shifting fast – and the biggest growth story of 2025 isn’t unfolding in shiny malls or corporate boardrooms. It’s happening in spaza shops, street markets, wholesale hubs, and stokvel networks that form the backbone of the South African informal economy.

In 2025, the informal retail sector grew by 23.6%, outpacing the 14.7% growth of corporate retail. This surge highlights how informal retailers – agile, community-driven, and deeply connected to everyday South Africans – are reshaping the nation’s shopping habits.

This is the new face of South African retail: informal, local, and thriving.

The Heart of the Informal Economy

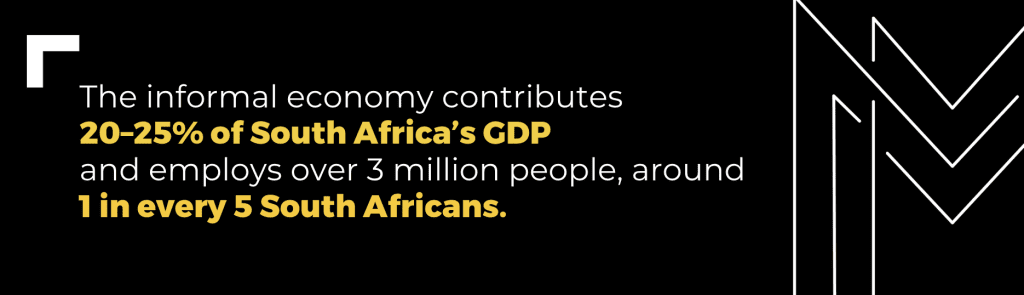

The informal economy has long been part of South Africa’s social and economic fabric – where entrepreneurship meets resilience. From township spaza shops and street vendors to local tuck shops, these small businesses employ around one in five South Africans and contribute roughly 20–25% of GDP.

Beyond the numbers lies their strength: proximity to people. Informal traders exist where consumers live, work, and commute – understanding local needs instinctively and responding in real time. In a world where trust and convenience matter most, that’s a serious competitive edge.

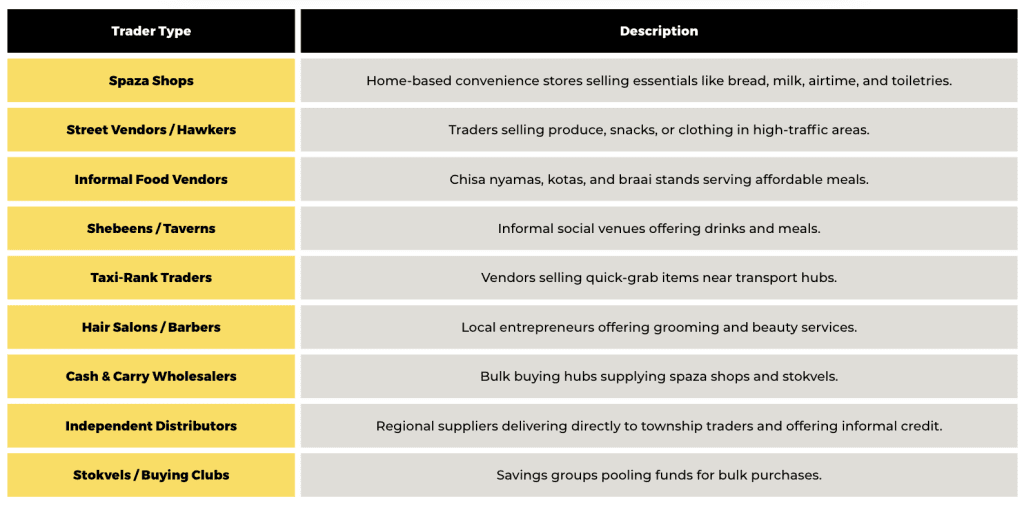

Who Makes Up the Informal Retail Sector?

South Africa’s informal economy is a complex network of traders, wholesalers, and community groups keeping commerce alive at street level.

The Wholesale & Distribution Connection

While the informal sector is made up of thousands of small traders, it’s powered by wholesalers and distributors who bridge the gap between brands and communities.

Cash & Carry stores act as central buying points for spaza owners and stokvels, offering competitive pricing and flexible quantities. Alongside them, independent wholesalers and distributors – often family-run – manage last-mile delivery to traders who can’t reach Cash & Carry outlets. They know their customers personally, extend informal credit, and adjust stock to match local demand.

Together, these wholesale networks form the backbone of South Africa’s informal supply chain – one driven by efficiency, the other by personal connection.

For FMCG brands, this is where the path to the informal consumer truly begins. These environments are not just transactional; they’re influence hubs where pricing, visibility, and education shape downstream demand.

What’s Driving the Boom

Several key forces are fuelling this rapid growth:

1. Price and accessibility – Rising living costs are pushing consumers toward informal traders who offer smaller pack sizes, local credit, and fair pricing.

2. Digital transformation – Fintech innovation is helping traders accept digital payments and access micro-loans, bridging formal and informal systems.

3. Local trust and agility – Informal traders pivot quickly, meeting changing community needs faster than formal retailers.

4. Wholesale ecosystems – The combined reach of Cash & Carry wholesalers and independent distributors keeps national brands accessible and affordable across townships and rural markets.

The Stokvel Effect: Seasonal Spending Power

Few forces influence informal retail like Stokvel Season – when millions of South Africans unlock a wave of collective buying power.

There are over 800,000 stokvel groups, representing 11 million members and controlling an estimated R50 billion. Around 80% of grocery stokvels make bulk purchases once a year, typically between October and December, fuelling massive demand for essentials like maize meal, rice, and cooking oil.

During this period, township wholesalers, independent distributors, and spaza shops all experience a sharp rise in sales – proof of how stokvels drive both liquidity and loyalty in the informal economy.

For deeper insight, read our blog A Guide to Effective Stokvel Marketing Strategies – it explores how brands can authentically engage stokvels and align campaigns with their buying cycles.

How Brands Are Responding

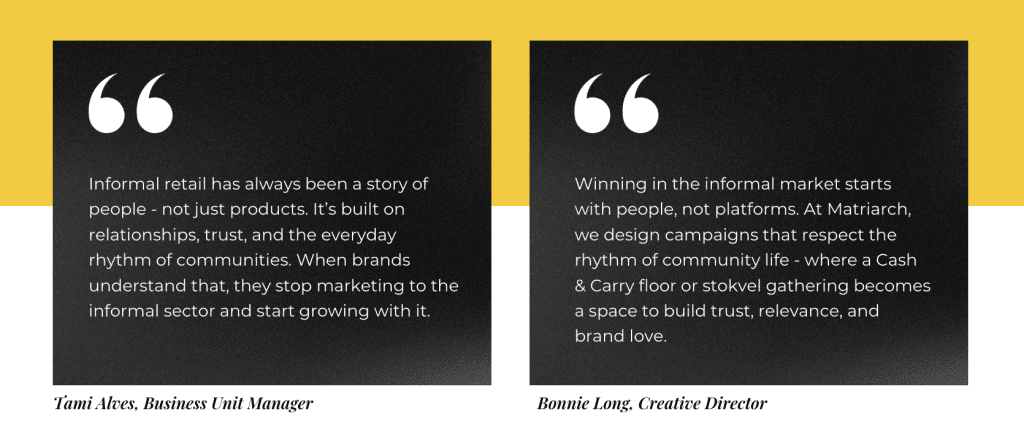

Forward-thinking brands now see the informal retail sector as a growth powerhouse, not a side channel. Many are engaging through community-based activations, bulk-buy promotions, and wholesale loyalty initiatives.

At Matriarch, we’ve seen how authentic engagement in Cash & Carry environments and independent wholesale spaces drives measurable impact.

Our Pioneer Foods Siyanqoba Stokvel Club campaign is one example – empowering stokvel members through education, engagement, and reward while building lasting brand loyalty.

The Future of South African Retail

The line between formal and informal retail is blurring. From digital spaza shops to stokvel-driven bulk buying and agile distribution networks, the informal economy is now central to South African commerce.

For brands, the opportunity lies in listening and localising – creating experiences that speak to real people in real communities.

Because the future of shopping in South Africa isn’t confined to malls — it’s alive in every township market, every stokvel meeting, and every Cash & Carry aisle.

And in that everyday hustle, the next retail revolution is already underway.